Introduction: In the dynamic landscape of business operations, staying compliant with tax regulations is crucial. At KartBlue, we are excited to announce our successful integration with Zatka, a move that empowers businesses in Saudi Arabia to effortlessly update their tax information on the government’s Fatoora Portal. This groundbreaking integration simplifies the tax compliance process, providing a seamless experience for businesses of all sizes.

Simplifying Tax Updates with Zatka Integration

Connecting Businesses and Zatka:

Our mission at KartBlue is to make essential business processes more accessible and efficient. With our integration with Zatka, businesses can now easily connect their systems to the Zatka platform. This connection enables a smooth flow of information, allowing businesses to update their tax details effortlessly.

Streamlining Tax Compliance:

Navigating the intricacies of tax compliance can be a daunting task for businesses. However, with KartBlue’s integration with Zatka, the process becomes streamlined. Our solution ensures that businesses can efficiently manage their tax-related data, reducing the risk of errors and enhancing overall compliance.

Key Features of KartBlue’s Zatka Integration

1.User-Friendly Customer Onboarding:

We understand that the first step in tax compliance is accurate customer information. KartBlue’s user-friendly interface simplifies the customer onboarding experience, allowing businesses to input essential details seamlessly.

2.CSID Generation for System Connectivity:

Our integration includes a CSID (Customer System ID) generation feature, offering businesses a unique identifier for connecting their systems with Zatka. This ensures a secure and efficient link between the two platforms.

3.Invoice Generation Made Easy:

Creating and managing invoices is a breeze with KartBlue. Businesses can leverage our integrated system to generate invoices effortlessly, enhancing their overall financial processes.

4.Secure Account Connection with Zatka:

Security is a top priority for KartBlue. Our integration ensures a secure account connection process, protecting sensitive data during the transfer between user accounts and Zatka.

How Businesses Benefit

Time and Cost Efficiency:

By automating and streamlining tax-related processes, businesses can save valuable time and resources. The seamless integration with Zatka reduces manual efforts, allowing businesses to focus on their core operations.

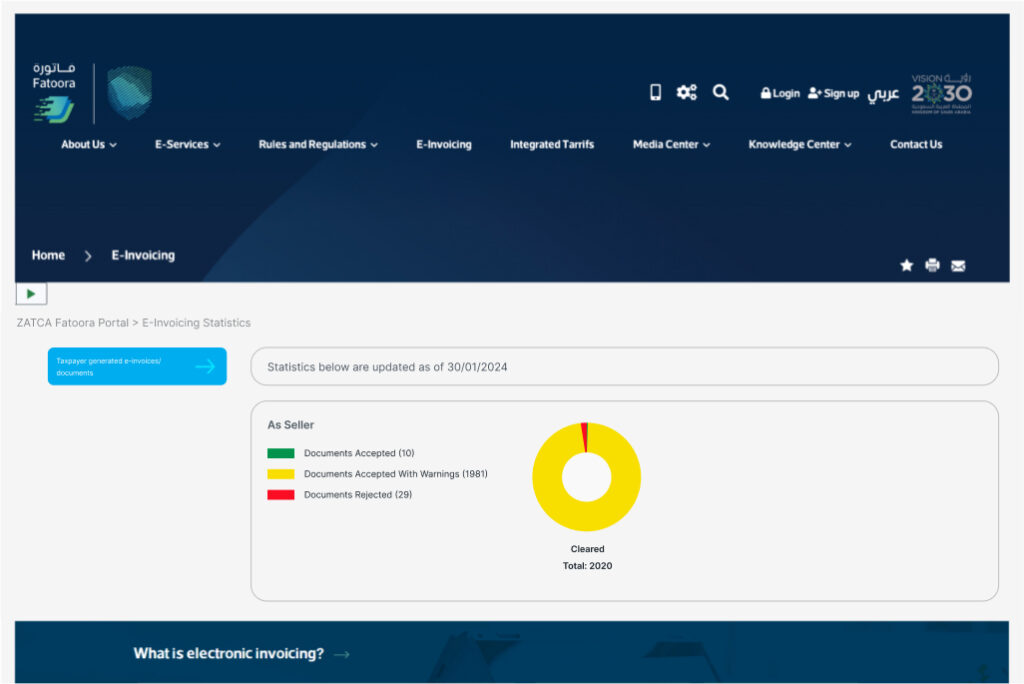

Enhanced Accuracy and Compliance:

Eliminating manual errors is crucial in maintaining accurate tax records. KartBlue’s integration with Zatka ensures data accuracy, minimizing the risk of compliance issues and penalties.

Scalability and Adaptability:

Our solution is designed to cater to businesses of all sizes. Whether you’re a start-up or an established enterprise, KartBlue’s Zatka integration provides scalability and adaptability to meet your evolving business needs.

Conclusion

KartBlue’s successful integration with Zatka marks a significant milestone in our commitment to empowering businesses in Saudi Arabia. We believe that by simplifying taxrelated processes, we contribute to the growth and success of our clients. To explore how KartBlue can enhance your business operations through seamless integration with Zatka, visit http://www.kartblue.com today.

Join us on this transformative journey as we continue to innovate and provide cutting-edge solutions for businesses navigating the complexities of tax compliance in Saudi Arabia.